Share

EmailPension benefits are typically a fixed monthly payment in retirement that is guaranteed for life. Some pension benefits grow with inflation. Other pension benefits can be passed on to a spouse or dependent. But pensions aren’t the only financial route to guaranteed lifetime income after you retire.

What makes pensions unique is that the retirement income benefit is determined by a formula that does not take into account the amount of money actually saved. In other words, the amount of the pension stays the same even if the retirement system isn’t keeping up with saving money to pay the benefit.

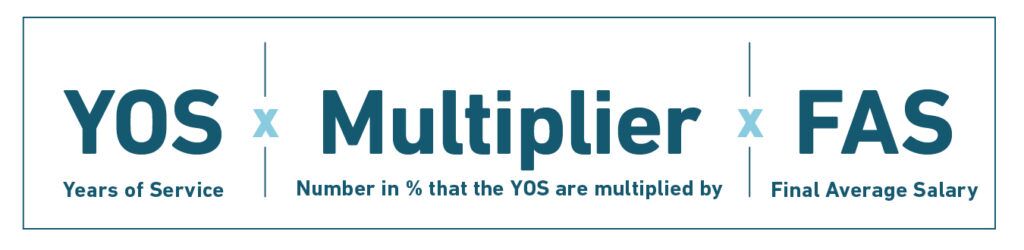

Here is how the formula typically works:

In the formula “years of service” is how many qualifying years a public worker has worked for their employer within the pension plan.

“Final average salary” is defined slightly differently from state to state, but always is a reference to the compensation amount that a pension will be based on. In most states, a final average salary — also called final average compensation — is the average of the last five years of work, or the last three years. Other states use the three or five highest years of salary, rather than the years at the end of your career.

The “multiplier” in the formula is used to determine the percentage of final average salary that will be received as a retirement benefit. Years of service are multiplied using this specific number. That amount becomes a percentage of final average salary. And the result equals the amount ultimately received as a benefit in retirement. The higher the multiplier, the larger the benefit. Multipliers are sometimes known by other terms, such as “accrual rate” or “crediting rate” but they mean the same thing.

A typical multiplier is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension would be 30 x 2% x $75,000 = $45,000 a year. That $45,000 becomes your guaranteed lifetime income.

Note: Your years of service times the multiplier (in this case, 30 x 2% = 60%) is known as your “replacement rate,” or the percentage of your final average salary that you’ll ultimately receive.

To find out if your retirement plan will provide adequate income, look up your plan’s interactive scorecard in theRetirement Security Report

This article is part of Equable’s Pension Basics series. To learn more about how your pension works, check out the other articles in the series:

1. How Pension Benefits Are Calculated

2. Vesting

3. The Pension Funding Formula

5. Normal Cost

6. Unfunded Liabilities (aka Pension Debt)

7. Actuarially Determined Contributions

10. Governance

11. Pension Myths & Facts:The Assumed Rate of Return Does Not Determine the Value of Benefits

12. Pension Myths & Facts: The Funded Status of Pension Plans Does Not Depend on More Public Employees

Share

Email - Shopify Philippines)